student loan debt relief tax credit for tax year 2020

Instructions are at the end of this application. Applying test-optional has its perks but I would advise you to take SATACT study hard for it and retake it a couple of times if needed.

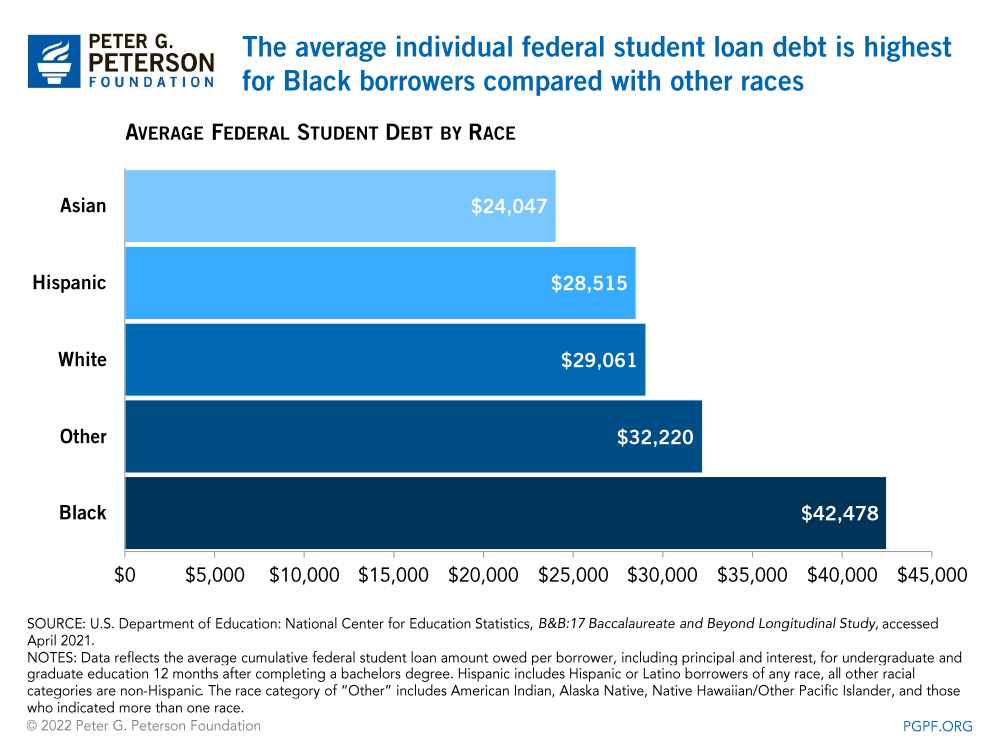

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

The average test scores are increasing by the year with the average SAT score being around 1380-1450 and the average ACT score is 31.

. Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases. The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had. WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school.

January 16 2020 by Ed Zollars CPA. For Maryland Residents or Part-year Residents Tax Year 2020 Only. Complete the Student Loan Debt Relief Tax Credit application.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and. Student Loan Debt Relief Tax Credit Application. The Student Loan Debt Relief Tax Credit is a program created under 10-740.

One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt. In fact the 2500 deduction can be utilized by holders of both Federal and Private student loan debt as. If you are looking for some help 17.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. This benefit originally included in the Coronavirus Aid Relief and Economic Security CARES Act enacted in March 2020 was for calendar year 2020 only but was extended for an additional five years by the Consolidated Appropriations Act 2021 CAA. Last year MHEC awarded the Student Loan Debt Relief Tax Credit to 7962 Maryland residents.

The Student Loan Debt Relief Tax Credit Program for Tax Year 2021 is open for applications through Sept. The Maryland Higher Education Commissionmay request additional documentation supporting your claim for this or subsequent tax years. You must provide an email address where MHEC.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university. Subsequent legislation extended the tax-free status through the end of 2025. It requires a completely separate form attached to a Form 1040 tax return and receipt of a Form 1098-T from the institution where the student was enrolled.

Employers can provide up to 5250 annually in tax-free student loan repayment benefits per employee through 2025. Student Loan Debt Relief Tax Credit for Tax Year 2020. Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be free from payroll and income tax under a provision in the Coronavirus Aid Relief and Economic.

Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available. How to apply. Relief is also extended to any creditor that would otherwise be.

From July 1 2022 through September 15 2022. Complete the Student Loan Debt Relief Tax Credit application. If youre married your spouses income or loan debt will be considered only if you file a joint tax return or you choose to repay your Direct Loans jointly 18.

The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. If you paid 600 or more in interest on your student loans in 2020 you should automatically receive a Form 1098-E in the mail or via email from your student loan servicer.

There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions and will each receive 875 in tax credits. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. Currently owe at least a 5000 outstanding student loan debt balance.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. From July 1 2022 through September 15 2022.

Up to 5250 in employer-paid educational assistance including tuition and LRAPs is tax-free. As part of relief for the COVID-19 pandemic the federal Coronavirus Aid Relief and Economic Security CARES Act passed in March provides significant student loan relief in the form of deferring payments and waiving interest until Sept. The legislation also allows companies to offer up to 5250 toward an employees student loan payments on a tax-free.

The CARES Act made employer-paid student loan repayment assistance programs or LRAPs temporarily tax-free in 2020.

Chart Americans Owe 1 75 Trillion In Student Debt Statista

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Student Loan Forgiveness Statistics 2022 Pslf Data

Student Loan Forgiveness Changes Who Qualifies And How To Apply Under Biden S Expansion Of Relief

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

Biden S Latest Student Loan Relief Includes This Major New Benefit

Coronavirus Student Loan Payment And Debt Relief Options Credit Karma

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

What Are The Pros And Cons Of Student Loan Forgiveness

What Are The Pros And Cons Of Student Loan Forgiveness

Taxes On Forgiven Student Loans What To Know Student Loan Hero

What Are The Income Limits For Student Loan Forgiveness As Usa

What Are The Pros And Cons Of Student Loan Forgiveness

Who Pays For Student Loan Forgiveness Forbes Advisor

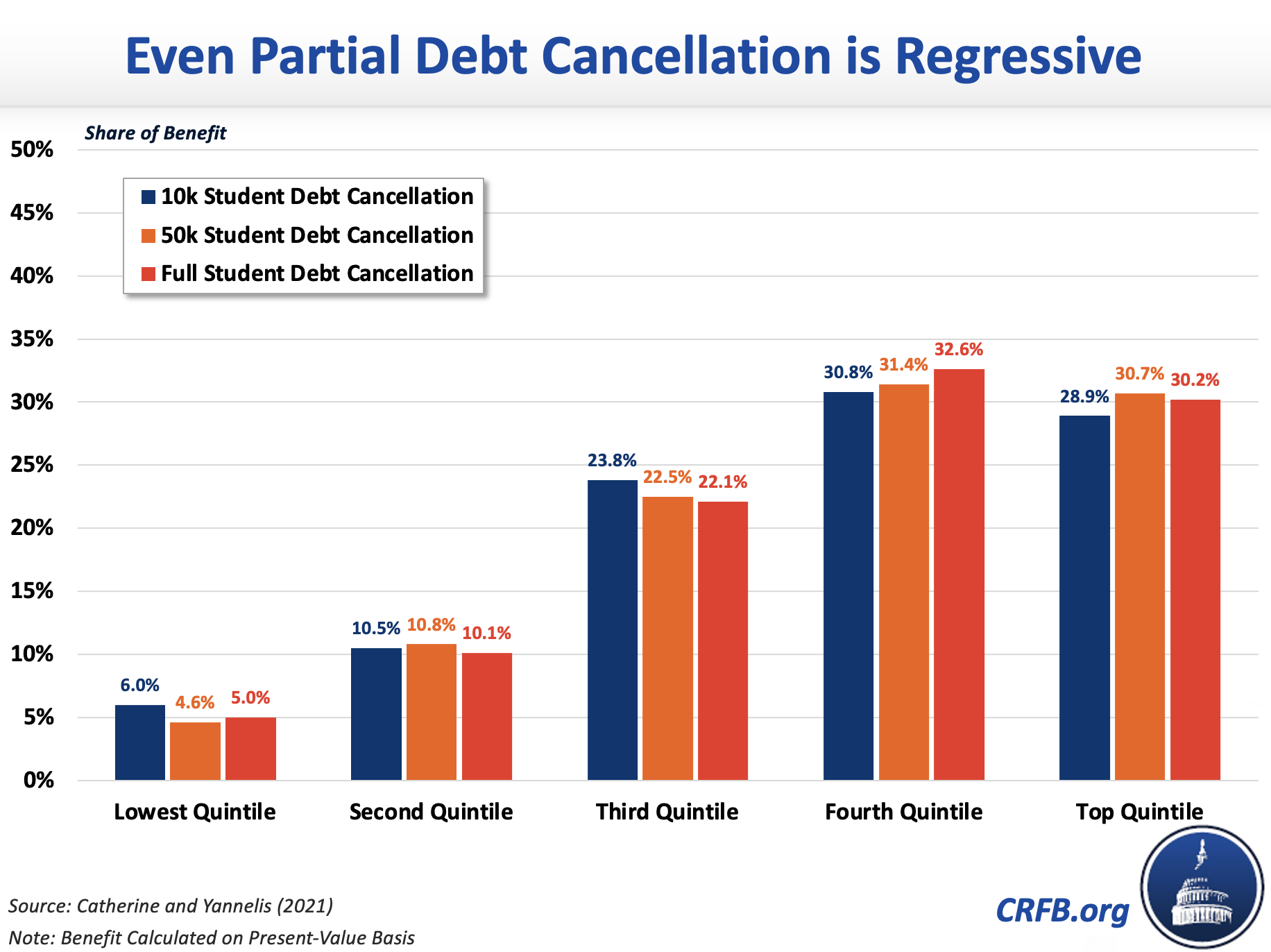

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Learn How The Student Loan Interest Deduction Works

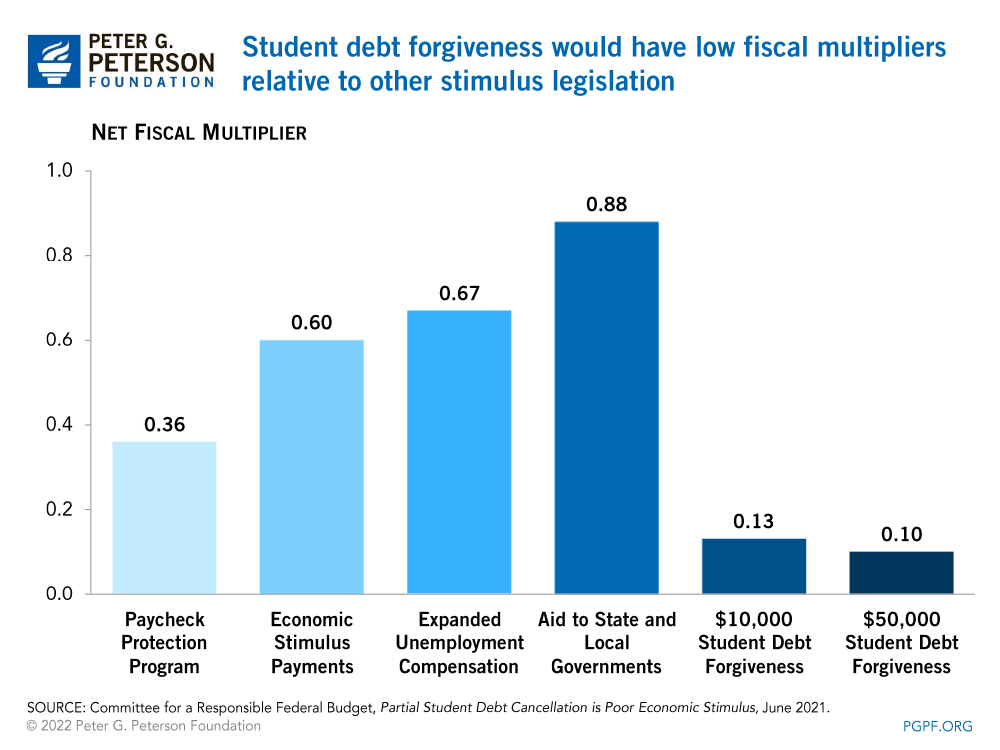

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

3 Smart Rules For Successful Budgeting Money Infographic Infographics Finance Personalfinance Money Debt Debtfre Smart Rules Budgeting Financial Tips